will the salt tax be repealed

A rollback of the cap on the state and local tax SALT deduction is on ice after Sen. Nov 19 2021.

House Democrats Propose Increasing Salt Cap To 72 500 Through 2031

However the bill stalled in December.

. The on-and-off cap The plan reportedly would repeal the SALT cap for 2022 and 2023 only. Why repealing SALT could create a windfall for the wealthy While the maneuver may offer tax savings for some business owners it may not be the right move in all cases financial experts say. Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

That was bad news for top earners in blue states such as California and New York. As policymakers weigh whether to lift or repeal. A group of Blue State Democrats has insisted on some SALT fix as their price for.

But the Tax Cuts and Jobs Act limited that deduction to 10000. The HENRYs high earners not rich yet were treated well by. SALT Agreement Near as Lawmakers Eye Two-Year Repeal of Limit by Laura Davison 92821 A key Democratic lawmaker said a detailed final agreement to restore the federal deduction for state and local taxes could be reached this week with another advocate flagging a temporary repeal of the breaks limit as the likely proposal.

According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less. Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent. To avoid cutting taxes for households making over 1 million some politicians have suggested eliminating the State and Local Tax SALT deduction cap for households making below 900000 or 950000 per year.

Even those making between 17500 and 250000 would get a tax cut of just over 400 or about 02 percent of after-tax income. Such legerdemain would be clever if it were not such an old trick. In part one of a two-part series Baker Botts William Gorrod Renn Neilson Matthew Larsen Jon Feldhammer and Ali Foyt share how a growing number of pass.

By contrast the higher SALT cap would boost after-tax incomes by 12 percent for those making between about 370000 and 870000. A two-year SALT cap repeal. The trend among states to adopt elective pass-through entity taxes or PTETs emerged as a measure to decrease the impact of the SALT cap which was introduced under the 2017 Tax Cuts and Jobs Act.

Democrats reportedly are considering a plan to repeal the 2017 cap on the state and local tax SALT deduction for 2022 and 2023 only. According to a committee aide a proposal on the table would repeal the 10000 cap for the 2021 through 2025 tax years. Its a blow for Schumer who is up for reelection this year and pledged in 2020 to make repeal of the cap on SALT deductions a top priority if Democrats won control of.

SALT Repeal Just Below 1 Million is Still Costly and Regressive. Its a blow for Schumer who is up for reelection this year and pledged in 2020 to make repeal of the cap on SALT deductions a top priority. Everything Keeps Coming Up Roses for the 200000 to 500000 Set.

It would then be reinstated for five years after that which the aide. Because of how Republicans structured the 2017 law the SALT cap is set to expire and the top rate. As Congress struggles to pass the Build Back Better bill some congressional Democrats are exploring new proposals to raise the 10000 cap on the state and local tax SALT deduction.

As it is it is merely irresponsible. A new bill seeks to repeal the 10000 cap on state and local tax deductions. It would repeal the SALT cap for three years while raising the top income tax rate for six years.

Such a plan would be still be very costly and regressive. Joe Manchin D-WVa raised broader objections to President Bidens social spending and climate package. A Democratic proposal aims.

Paying a state income tax of 10 percent or more. Democrats leave SALT cap repeal out of initial version of tax plans Zachary Halaschak September 13 2021 1044 AM D emocrats released the first look at proposed tax changes for their. Over 50 percent of this reduction would accrue to taxpayers in just four.

House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before reinstating the 10000 limit in 2031. It would reduce their 2021 taxes by an average of only 20. October 4 2021.

This would be in place of the House plan to lift the cap to 80000 through 2030 and reinstate it at 10000 for 2031.

Democrats Consider Salt Relief For State And Local Tax Deductions

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

How To Build A Fun Family Time Capsule My Silly Squirts Family Fun Time Time Capsule Time Capsule Kids

Gaming The Salt Cap May Be Congress S Worst Tax Idea Of The Year

12 New Year S Resolutions For Optimal Health In 2019 Hochzeits Dj Mutterschutz Kleine Zitate

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Democrats Prepare Plan To Pass Salt Cap Relief Tax Break For Wealthy

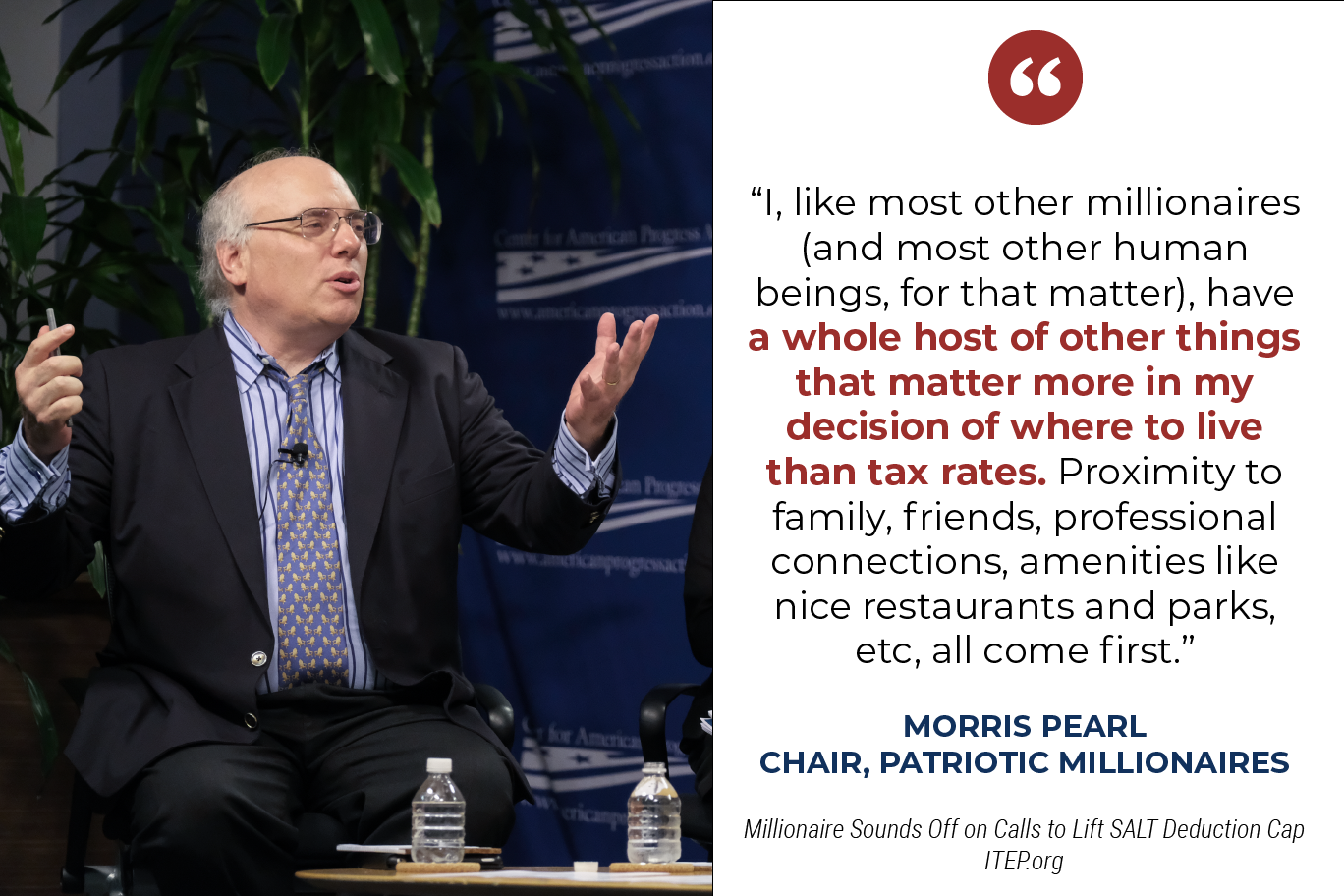

Latest Proposal From Senate Democrats Would Bar The Rich From Salt Cap Relief Itep

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

The Salt Deduction There S A Baffling Tax Gift To The Wealthy In The Democrats Social Spending Bill The Washington Post

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

State And Local Tax Deduction Cap Back In Play For Coronavirus Relief Package Roll Call

Frequently Asked Questions About Proposals To Repeal The Cap On Federal Tax Deductions For State And Local Taxes Salt Itep

Salt Deduction Cap Durbin Duckworth Restate Call For Repeal In D C Memo Crain S Chicago Business

This Bill Could Give You A 60 000 Tax Deduction

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

3 Money Saving Tax Tips For Homeowners Utah Listing Pro Save Money Tax Tips Homeowner Tips Tax Season Real Estate Ta Tax Money Tax Season Saving Money