san francisco gross receipts tax apportionment

Administrative Office Tax For any business maintaining an administrative office in the city the tax is graded based on companies CEO pay ratio 04 of companies total taxable payroll. The voters of San Francisco the City recently approved Proposition E a gross receipts tax that will be phased in over five years beginning in 2014.

Seattle And San Francisco Look To Recoup Revenues Lost During Covid 19

First San Francisco requires two separate filings.

. Confusion with San Franciscos gross receipts tax centers on two aspects of the tax. And Arts Entertainment and Recreation. A For all persons required to determine an amount of gross receipts pursuant to this Section that amount shall be all non-exempt combined.

For the 2020 tax year non-exempt taxpayers engaging in business within the City that had more than 1200000 of combined taxable San Francisco gross receipts are. In this Insight we we look at nexus the NAICS. On November 6 San Francisco voters approved Measure E which imposes a gross receipts tax on persons engaged in business activities in San Francisco.

Note that San Francisco Payroll and Total. Gross Receipts Tax Applicable to Accommodations. All persons deriving gross receipts from business activities both within and outside the City shall allocate andor apportion their gross receipts to the City using the rules set forth in.

If you are engaged in multiple business activities complete a worksheet for each business activity to calculate your San Francisco gross receipts. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. Thats because San Francisco asks businesses to calculate their gross receipts tax burden in part on the portion of their overall payroll thats earned in the city.

Lean more on how to submit these installments online to. If you are engaged in multiple business activities complete a worksheet for each business activity to calculate your San Francisco gross receipts. Gross Receipts Tax and Payroll Expense Tax.

Gross domestic product GDP is a monetary measure of the market value of all the final goods and services produced and sold not resold in a specific time period by countries. Note that San Francisco Payroll. Reporting requirements and computation.

Second San Francisco applies separate reporting years to each filing. In an effort to eliminate this perceived tax disincentive in November 2012 San Francisco voters passed Proposition E Prop E enacting the Gross Receipts Tax which. The gross receipts tax return and the annual business registration.

Apportionment for this Section is 50 Real Personal Tangible and Intangible Property and 50 Payroll Expense Section 9535. Calculating the San Francisco Gross Receipts Tax. Apportionment of receipts based on payroll.

Apportionment for this Section is 50 Real Personal Tangible and Intangible Property and 50 Payroll Expense Section 9535 c. Gross Receipts Tax Applicable to Private Education and Health. 21 rows Select your business activity from the list below to access the appropriate allocation andor apportionment worksheet to determine your San Francisco gross receipts.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the. 1 This gross receipts tax will. Calculating the San Francisco Gross Receipts Tax.

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

San Francisco Gross Receipts Tax

San Francisco Begins Transition To Gross Receipts Tax The Bar Association Of San Francisco

A New Dimension For Llcs In California

San Francisco Gross Receipts Tax Clarification

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Texas Comptroller Revisions Dallas Business Income Tax Services

State Gross Receipts Tax Rates 2021 Tax Foundation

Annual Business Tax Returns 2020 Treasurer Tax Collector

Empirical Evidence On The Revenue Effects Of State Corporate Income Tax Policies Mary Ann Hofmann Academia Edu

Nevada Voters To Consider Economically Damaging Gross Receipts Style Tax A Type Only Five Other States Have Tax Foundation

San Francisco Gross Receipts Tax

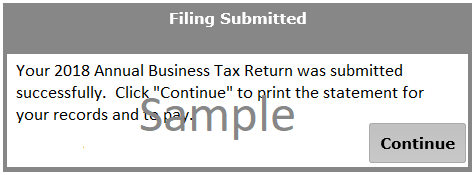

Annual Business Tax Return Instructions 2018 Treasurer Tax Collector

State By State Guide Which States Have Gross Receipts Tax Taxvalet Sales Tax Done For You

A New Dimension For Llcs In California

Annual Business Tax Returns 2019 Treasurer Tax Collector

Got Losses Why Pre Revenue Start Ups And Companies With No Gross Receipts Should Seek Relief From California S Standard Apportionment Formula Andersen